The Spanish property market has always been particularly appealing to UK buyers. Despite the Covid-19 pandemic temporarily demotivating buyers, demand is rising once again, with homebuyers keener than ever to find their dream property in Spain.

However, the recent fluctuations in the GBP to Euro exchange rate have caused uncertainty amongst buyers, with many expressing concern at the fast-changing rate and the impact it may have on their purchase.

Here, we’ll provide in-depth insight into how the Pound-Euro exchange rate may affect your home purchase in Spain, and what to look out for.

How do exchange rates affect the purchase of a property?

Home buyers are often unaware of the profound impact currency exchange rates can have on a popular property market with a variety of international buyers.

Exchange rates chiefly affect foreign property investors – if one’s own currency increases in value so does their purchasing power, and therefore their ability to buy property abroad that generates high return on investment.

There is a well-known link between the value of a country’s currency and its house prices.

Currency increasing or decreasing in value causes changes in the overall value of properties themselves, as local currency becoming stronger translates to higher prices and vice versa, in turn determining how attractive properties are to foreign buyers.

Inflation and interest rates also have a role to play, as weak domestic prices can increase both, reducing demand.

The best time to buy a property in a foreign country is when your own currency strengthens against that of the country you are buying in, particularly when it becomes stronger than it has been in the past years.

How has the Pound to Euro exchange rate changed?

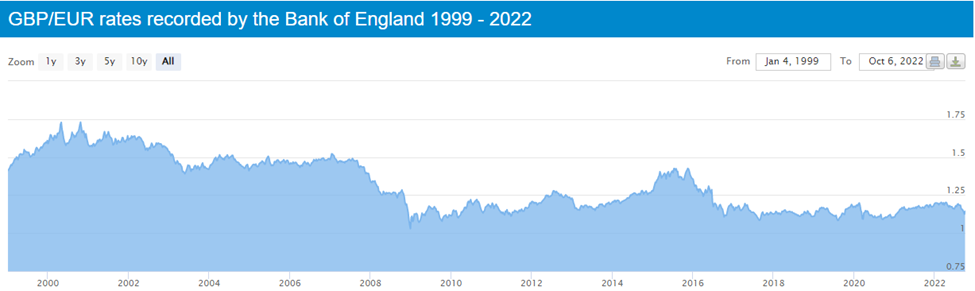

In May 2000, the GBP was particularly strong against the Euro, with the Pound to Euro exchange rate sitting at 1.752.

With the GBP to Euro exchange rate throughout 2022 sitting at an average of 1.1805 and more uncertainty predicted for the future, buyers are justifiably concerned.

The Pound has notoriously been a strong currency over the years, but its value has dropped in recent years due to the rise in borrowing due to high inflation, less inward capital investment and trade friction since Brexit, amongst other factors.

The Pound-Euro exchange rate also sunk to a new two-year low in October as a result of the tax cuts in the UK Government’s mini-budget.

However, it may now be on its way to recovery due to Prime Minister Liz Truss’ tax cut reversal.

The road ahead is filled with uncertainty, with changes in exchange rates depending on market sentiment, though experts seem optimistic.

(Source: poundsterlinglive.com)

What does this mean for property buyers?

With the value of the GBP changing so rapidly, many may be wondering whether investing in the Spanish property market is still a secure option.

Though UK property buyers may be obtaining less value for money than if they were buying when the Pound was at its most valuable, we must remember that fluctuations in the value of currency are inevitable, and a constant thread in the world of investments.

Nevertheless, the Pound still remains stronger than the Euro, meaning investing in Spanish property remains a worthwhile choice in most cases.

And while keeping an eye on changes within currency rates in both countries is paramount, enlisting the help of experts with in-depth knowledge of the real estate market is essential.

Andrew Brown has a wealth of experience matching UK clients to their ideal home in Spain, confidently guiding them through every step of purchasing a property and advising them on the most suitable course of action in line with their individual needs.

The Andrew Brown team can provide added value by offering advice on the state of the market and helping clients make the best possible choices to obtain a return on their investment.

For more information, please get in touch with Andrew Brown today.